Saving money is a goal many of us share, but it often feels challenging when expenses seem to pile up. The good news is that you don’t need to make drastic lifestyle changes or take on a second job to see real savings. By adopting simple, consistent habits at home, you can reduce costs and boost your monthly savings without feeling deprived. Here’s a practical guide on how to save money at home every month.

1. Track Your Spending

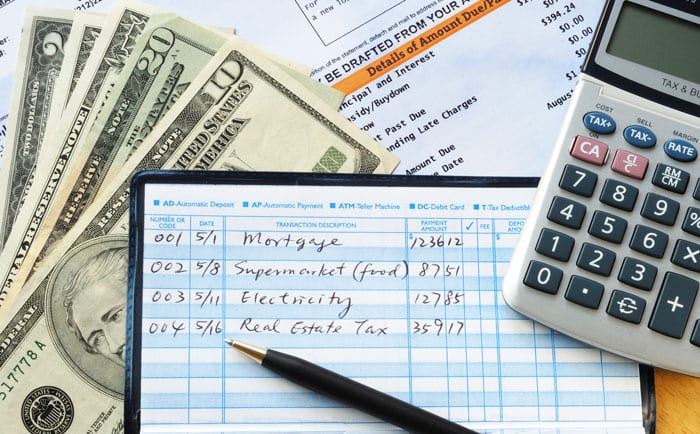

The first step to saving money is knowing exactly where it goes. Start by tracking every expense for at least a month. Use a notebook, spreadsheet, or one of the many budgeting apps available today. Once you can see patterns—like how much you spend on snacks, electricity, or subscriptions—it becomes easier to identify areas for cuts. Small leaks in your budget, when addressed, can accumulate into significant savings.

2. Cut Down on Utility Bills

Utility bills can be surprisingly high if not monitored carefully. To save money:

- Turn off lights, fans, and appliances when not in use.

- Use energy-efficient LED bulbs.

- Unplug electronics that draw “phantom energy” even when off.

- Limit water waste by fixing leaky faucets, taking shorter showers, and using water-efficient appliances.

Simple adjustments like washing clothes in cold water or air-drying clothes can also reduce electricity and water bills substantially.

3. Reduce Food Waste

Food is one of the biggest monthly expenses for households. To save money:

- Plan your meals for the week and create a shopping list to avoid impulse buys.

- Store food properly to extend its shelf life.

- Use leftovers creatively, turning yesterday’s dinner into today’s lunch.

- Buy in bulk for items you use frequently, but avoid purchasing perishable goods in excess.

By reducing food waste, you’re not just saving money—you’re also helping the environment.

4. Limit Subscription Services

Streaming services, magazines, apps, and other subscriptions add up quickly. Review your recurring expenses and ask yourself which subscriptions you truly need. Cancel those you rarely use or share accounts with family or friends to split costs. This can save you a surprising amount every month with minimal lifestyle impact.

5. Embrace DIY Solutions

Before spending money on services or products, consider if you can do it yourself. For example:

- Clean your home with homemade cleaners using vinegar, baking soda, and lemon.

- Perform minor home repairs or maintenance yourself with online tutorials.

- Cook meals at home instead of ordering takeout.

DIY approaches not only save money but also give you a sense of accomplishment.

6. Shop Smart

When you need to buy something, shop strategically:

- Compare prices online before purchasing.

- Look for discounts, coupons, or cashback offers.

- Buy generic brands instead of expensive name brands—they often offer the same quality.

- Avoid impulse shopping by waiting 24 hours before making a purchase.

These habits can significantly reduce unnecessary spending over time.

7. Set a Monthly Budget

A clear budget gives you control over your money. Decide on fixed limits for essentials like groceries, utilities, and transportation, and allocate a portion for savings. Treat your savings as a non-negotiable expense; this ensures that you consistently put money aside each month rather than waiting for leftover funds.

8. Make Energy-Smart Home Improvements

Small investments in energy-efficient solutions can lead to long-term savings:

- Install programmable thermostats to reduce heating and cooling costs.

- Use insulated windows or draft stoppers to maintain temperature.

- Upgrade appliances to energy-efficient models if your budget allows.

Even small changes can reduce utility bills significantly over time.

9. Reduce Impulse Purchases at Home

It’s easy to spend on things “just because” while at home, whether shopping online or buying snacks. Curb this habit by:

- Making a shopping list and sticking to it.

- Avoiding online shopping when bored or emotional.

- Keeping a separate “fun money” budget to satisfy small cravings without guilt.

10. Make Saving a Habit, Not a Chore

Ultimately, the key to saving money every month is consistency. Start with small, achievable goals and gradually implement more strategies. Track your progress and celebrate milestones—it keeps motivation high and helps build lasting habits.

Conclusion

Saving money at home doesn’t have to be overwhelming. By tracking expenses, reducing waste, cutting unnecessary subscriptions, and making mindful purchasing decisions, you can make significant savings each month. Remember, it’s the small, consistent changes that add up over time. With patience and discipline, you can enjoy a more secure financial future while still living comfortably.

Leave a Reply